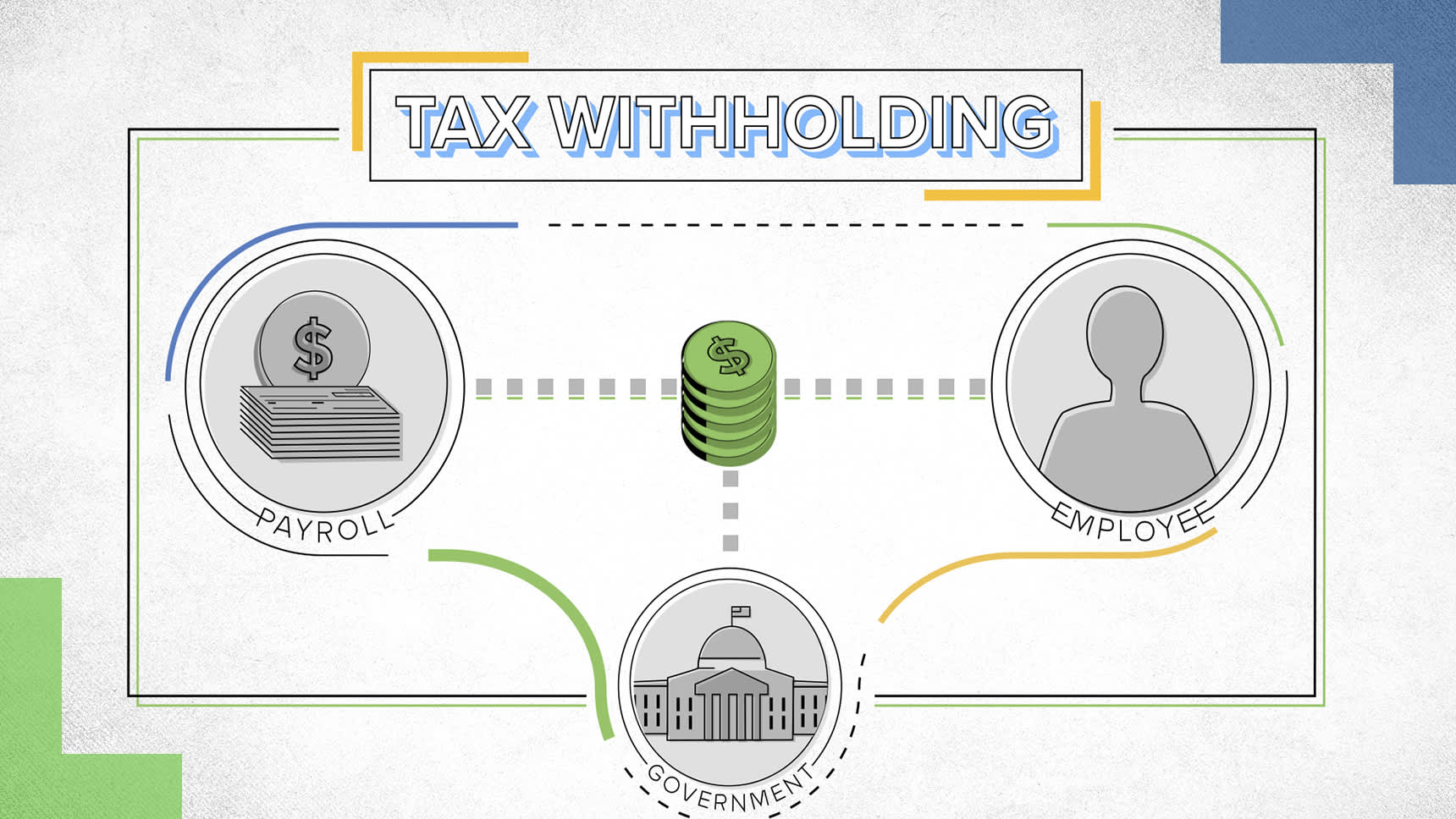

Figure tax withholding paycheck

The wage bracket method and the percentage method. The Withholding Calculator helps you.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

For employees withholding is the amount of federal income tax withheld from your paycheck.

. Tipalti provides a list of withholding rates so that payers know how much to withhold from payee payments and submit to the IRS. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Irecently changed jobs and make around 30 more than my previous job. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

For a long time it was assumed that the concept of immovable property in VAT and income tax was to be understood as being broadly congruent. Total Up Your Tax Withholding. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Tipalti provides a list of income types used to calculate the. The next estimated quarterly tax due date is Sept. The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

That result is the tax withholding amount. In 2020 the German. How to calculate annual income.

You find that this amount of 2025 falls in. The more allowances a worker claims the less money will be. I recently got my paycheck and was shocked to see that my bimonthly check only went up by.

The Withholding Form. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How to Check Your Withholding.

Ready to get your tax withholding back on track. How to Calculate and Adjust Your Tax Withholding. Then look at your last paychecks tax withholding amount eg.

When you have a traditional hourly or salaried job your employer withholds income taxes from your paychecks. There are two main methods small businesses can use to calculate federal withholding tax. For example if an employee earns.

250 minus 200 50. 250 and subtract the refund adjust amount from that. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

But the IRS introduced a new Form. The state tax year is also 12 months but it differs from state to state. Use the IRS Withholding Estimator to estimate your income tax and compare it.

The changes to the tax law could affect your withholding. A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. Free salary hourly and more paycheck calculators.

Some states follow the federal tax. The amount of income tax your employer withholds from your regular pay.

Pin On Baby Xiomara

Payroll Tax What It Is How To Calculate It Bench Accounting

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Calculating Federal Income Tax Withholding Youtube

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Taxpayers Can Follow These Three Steps To Use New Tax Withholding Estimator Tax Tax Services Income Tax Return

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

How To Calculate Federal Withholding Tax Youtube

Calculation Of Federal Employment Taxes Payroll Services

Understanding Your Paycheck

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

I Turned To Freelancing And Quadrupled My Assets In 3 Months Helping People How To Become Turn Ons

How To Calculate 2019 Federal Income Withhold Manually

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax